Have you ever tapped your card to buy a coffee without a second thought? It feels so simple, so modern. But that small piece of plastic in your wallet is the result of a long and fascinating journey. The history of credit cards didn’t start with banks or technology; it began with a simple idea: trust. It’s a story that stretches from ancient trading posts to a forgotten wallet at a New York dinner, ultimately changing how the entire world shops, travels, and lives.

This article will take you through the amazing evolution of credit cards. We’ll uncover the true origin of credit cards, meet the people whose ideas sparked a financial revolution, and see how a simple cardboard rectangle became the powerful tool we use every day.

Before Credit Cards: A World of IOUs

Long before the first credit card, people found ways to buy now and pay later. The concept of credit is as old as civilization itself, built on promises and reputation.

Ancient Credit: Promises on Clay

Imagine being a farmer in ancient Mesopotamia over 5,000 years ago. You need seeds for your next harvest but don’t have the silver to pay for them right now. What do you do? You’d go to a merchant and make a deal. The merchant would give you the seeds, and you’d make a promise to pay them back with a portion of your crops after the harvest.

This promise wasn’t just a handshake. It was recorded on a clay tablet, marked with seals from both you and the merchant. These tablets were the world’s first credit records. They were a simple but effective way to track who owed what, allowing trade and economies to grow. Similar systems existed in other ancient civilizations, from the Roman Empire to early China, proving that the need for credit has always been a part of human commerce.

The First “Store Cards”

Fast forward thousands of years to the late 19th and early 20th centuries. The idea of credit was still very local. If you were a regular at a general store, the owner might let you run a tab, which you’d settle at the end of the month.

To make this easier, some large department stores and oil companies started issuing their own “charge-plates” or “credit coins.” These were small metal plates, often with the customer’s name and address stamped on them. When you wanted to buy something, the clerk would take your plate and use a machine to imprint your details onto a sales slip. You’d sign the slip, and the store would bill you later.

These were a step towards the modern card, but they had a big limitation: you could only use them at the one store that issued them. If you had a charge plate for Sears, you couldn’t use it at Mobil gas stations. The world was waiting for a universal solution, and the true origin of credit cards as we know them was just around the corner.

The “Big Bang” of Credit: The Diners Club Card

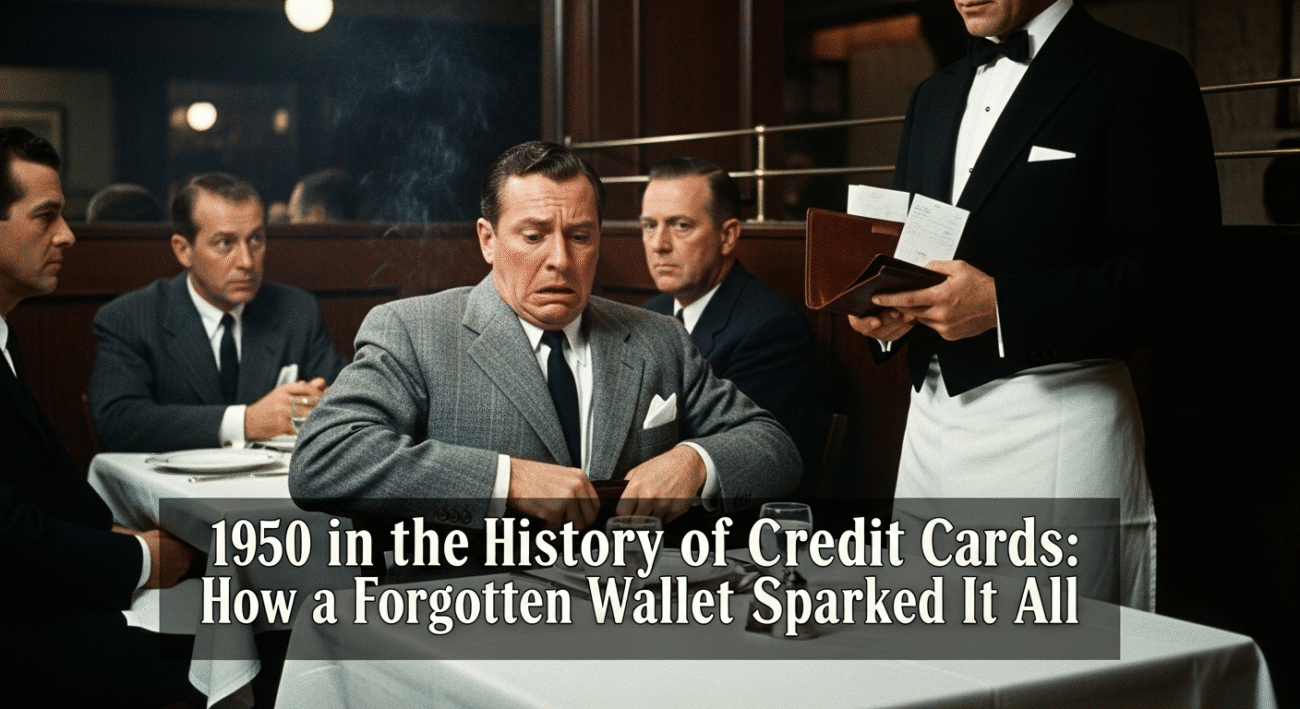

The real breakthrough in the history of credit cards came from a moment of forgetfulness. It’s a classic story that shows how a simple problem can lead to a world-changing idea.

A Dinner That Changed Everything

The year was 1949. A New York businessman named Frank McNamara was having dinner with clients at a restaurant. It was a successful meal, and when the bill came, he reached for his wallet to pay. But his pocket was empty. He had forgotten his wallet at home.

Embarrassed, McNamara had to call his wife and ask her to bring him some cash. The incident stuck with him. He thought, “There has to be a better way.” What if there was a single card you could use at many different restaurants, so you’d never be caught without money again?

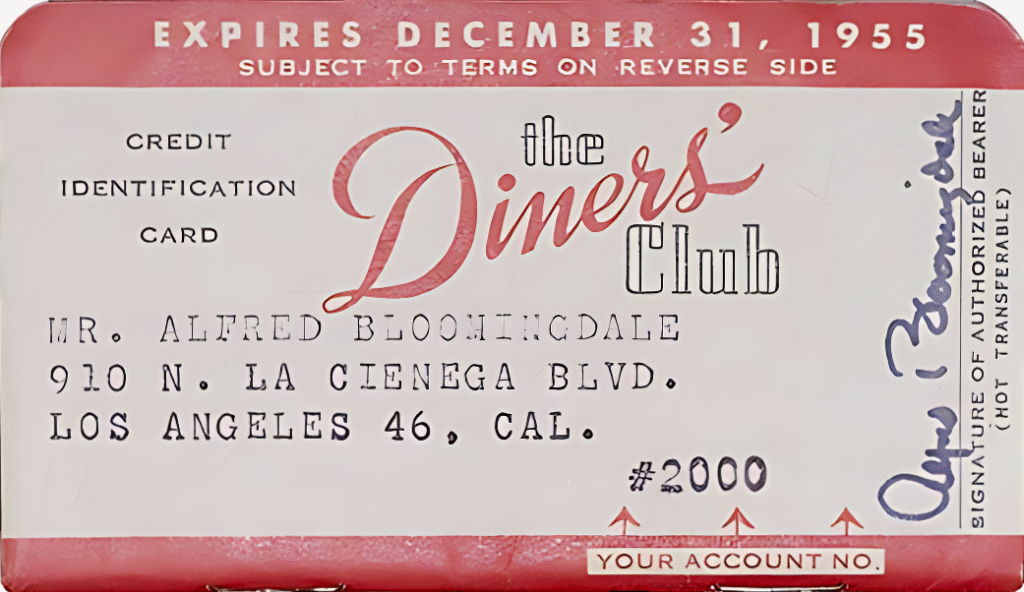

This idea became his obsession. A year later, in 1950, Frank McNamara returned to that same restaurant. When the bill came, he confidently placed a small cardboard rectangle on the table. It was the very first Diners Club card. The restaurant owner accepted it, and the concept of the general-purpose charge card was born.

How the First Card Worked

The Diners Club card was revolutionary. It wasn’t a credit card you had to pay your bill in full each month but it was a “charge card” that could be used at multiple places. Here’s how the system worked:

- For Customers: You paid a small annual fee (initially $3) to be a member of the “club.” This gave you the card and the privilege of dining out without cash.

- For Restaurants: Restaurants that wanted to accept the card paid Diners Club a small fee on each transaction (around 7%). In return, they got access to wealthy customers who were more likely to spend freely.

- The Middleman: Diners Club paid the restaurant for the meal and then billed the cardholder at the end of the month.

The idea took off. In its first year, the Diners Club card signed up 20,000 members. Soon, it wasn’t just for restaurants. Hotels, travel agencies, and other businesses joined the network. The success of the Diners Club card proved that a third-party payment system could work, laying the tracks for the entire credit card industry.

Banks Join the Race: The Rise of Visa and Mastercard

The success of Diners Club and a similar card from American Express didn’t go unnoticed. Banks saw a huge opportunity. They realized they could not only make payments easier but also lend money and earn interest. This was a key moment in the evolution of credit cards. evlo

The Revolutionary BankAmericard

In 1958, Bank of America decided to run a bold experiment in Fresno, California. Without any applications, they mass-mailed 60,000 fully activated credit cards to residents of the town. This card was called the BankAmericard.

This was different from the Diners Club card in one crucial way: it offered revolving credit. Cardholders didn’t have to pay the full balance each month. They could pay a small minimum amount and “revolve” the rest of the debt to the next month, with interest. This was the first true credit card as we know it today.

The launch, known as the “Fresno Drop,” was chaotic. There were issues with fraud and people getting into debt. But Bank of America learned from its mistakes and refined the system. The convenience of the BankAmericard was undeniable, and the idea of a bank-issued credit card began to spread across the country. The BankAmericard was a pivotal point in the history of credit cards, creating the model for how most cards work today.

Competition Creates Global Giants

Other banks wanted in on the action. To compete with the growing BankAmericard network, a group of other California banks banded together in 1966 to create their own card system. They called it the Interbank Card Association (ICA), which would later be renamed Master Charge, and eventually, Mastercard.

To make their cards more appealing worldwide, BankAmericard rebranded itself in 1976. They chose a name that was easy to pronounce in any language: Visa.

Now, there were two massive, competing bank card networks. This competition drove innovation, expanded acceptance to millions of merchants worldwide, and made credit cards a staple of modern life. This global expansion was a critical phase in the evolution of credit cards.

The Evolution of Credit Cards: From Plastic to Pixels

The journey from a simple cardboard rectangle to the digital wallets on our phones is a story of incredible technological progress. The evolution of credit cards has been all about making them faster, smarter, and more secure. cnet

The Magic of the Magnetic Stripe

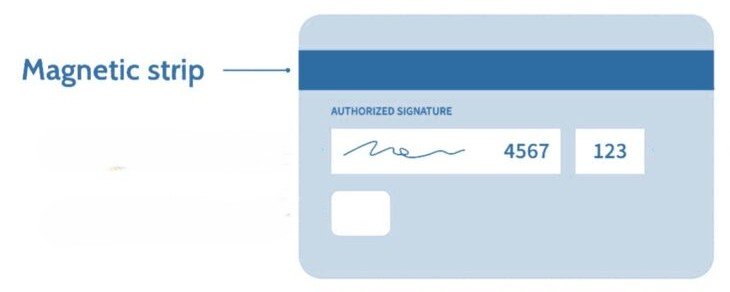

In the early days, processing a charge plate transaction was slow. A clerk had to use a clunky imprinting machine to copy your card’s details onto a paper slip. Verifying your account often meant a long phone call to the bank.

Everything changed in the 1970s when IBM perfected the magnetic stripe. This black stripe on the back of the card could store your account information digitally. Now, a clerk could just swipe the card through a terminal, which would instantly send the information to the bank for approval.

The magnetic stripe made transactions incredibly fast and efficient. It was a huge leap forward in the history of credit cards and became the global standard for decades.

Chips, Pins, and Taps

While the magnetic stripe was great, it wasn’t perfectly secure. The information could be copied by criminals, leading to fraud. The next big step in the evolution of credit cards was the EMV chip.

- The Smart Chip: Developed in the 1990s, this small, metallic square on the front of your card is actually a tiny computer. It creates a unique, one-time code for every transaction, making it almost impossible to counterfeit. This technology, often called “Chip and PIN,” dramatically reduced in-person fraud.

- The Tap-to-Pay Revolution: More recently, Near Field Communication (NFC) technology has allowed for contactless payments. You can now just tap your card or your phone on a reader to pay, making small purchases faster than ever.

From paper slips to secure chips and instant taps, the technology behind our cards continues to advance, making our financial lives easier and safer.

How Credit Cards Changed the World

The impact of credit cards goes far beyond just how we pay for things. They have fundamentally reshaped our economy, our culture, and our behavior. The history of credit cards is also a history of social change.

Technological Standards

A Symbol of Status and Modern Life

In the early days, having a Diners Club card or an American Express card was a status symbol. It showed you were a successful, modern person with financial clout. It meant you were trusted by a major financial institution.

As cards became more common, this “elite” status faded, but they remained a symbol of financial independence. For many people, getting their first credit card is a rite of passage into adulthood. They represent access, freedom, and the ability to participate fully in the modern consumer economy.

The Shift to a Cashless World

Credit cards were the first major step away from cash. They introduced the idea that you didn’t need physical bills and coins to buy things. This paved the way for the digital payment world we live in today.

- Convenience and Safety: Cards are safer and more convenient to carry than large amounts of cash.

- The Rise of E-commerce: The internet shopping boom would be impossible without credit cards. They provide the secure, instant payment method that online stores need.

- Changing Spending Habits: Studies have shown that people tend to spend more when using a card compared to cash. The “pain of paying” feels less real when you’re just swiping plastic, which has had a huge impact on consumer spending.

The origin of credit cards may have been about solving a simple problem, but their legacy is a world that is increasingly moving beyond physical money.

The Future of Your Wallet

The history of credit cards is far from over. Today, the physical plastic card is already starting to disappear into our smartphones and smartwatches through services like Apple Pay and Google Pay. The evolution of credit cards continues to accelerate.

The future will likely bring even more security, with biometrics like fingerprint and facial recognition becoming standard. New ideas like crypto-backed cards are also emerging. But no matter what form they take, the fundamental concept born from Frank McNamara’s forgotten wallet a trusted, universal way to pay will surely endure. The journey that started with a promise on a clay tablet now points toward a future of instant, invisible, and incredibly secure transactions.

The world is full of incredible oddities, and we’re committed to bringing them to your attention. If you found this article intriguing, imagine what else awaits. Our blog is a curated collection of strange and thought-provoking stories that explore the most bizarre happenings across the globe. Don’t miss out on your next fascinating discovery. Explore our blog section today.